I've been a big fan of TD Bank, formerly Commerce Bank, for more than twenty years. The innovative financial institution, started in south Jersey in the 1980s, popularized such concepts as seven-day banking and evening hours.

One aspect of their operation that I have been critical of is their "drive-thru" lanes, which do not include a drive-up ATM. I do not believe this is an oversight.

Part of the Commerce Bank/TD Bank business plan appears to be to force customers to enter the building to get cash. I guess that once inside, you're supposed to feel all warm and fuzzy about the bank and decide to put all of your money there - or take a big loan.

Still, it seems funny that "America's Most Convenient Bank" won't allow customers the convenience of the drive-thru ATM.

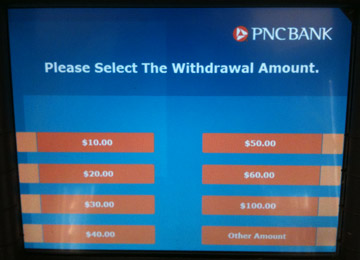

Up until this month, I have used a simple workaround. I have combined stops for coffee with necessary cash withdrawals by using the very consumer-friendly PNC Bank ATM at the WaWa on Triangle Rd., which for years has had no fee at all, from either PNC or TD Bank.

Imagine my surprise last week when I hit that button for $100 "fast cash" and was swiftly docked $102! Where did that $2 go? Not to PNC. It looks like TD Bank has found a convenient way to grab a couple bucks - a 2% commission in this case - from their loyal customers' transactions at WaWa.

What to do? Here's a clue - I won't be changing my coffee place.

Wawa used to advertise no-fee ATMs. I must admit I thought of them as the "Bank of Wawa." Especially the one on Triangle Road, because I could get cash, order Chinese take-out, do my dry cleaning, go to my chiropractor, and even buy shoes right in that shopping center. It's worth mentioning that when I withdrew cash at Wawa, I often bought coffee and maybe a donut or sandwich just because I was in there.

ReplyDeleteWell, I'm not doing the $2 thing, so I'll just go to Quick Check or get cash back on other debit card purchases. I'll still stop in Wawa sometimes, but not as often since I won't be using the ATM.

BD - Let me take this opportunity to clarify. WaWa is not charging or collecting ATM fees on their end, neither is the PNC Bank, who own the ATM at that location. On that end, everything is still free. The difference is that beginning this month, March. the bank where you have your account (in my case TD Bank) might now begin charging. That is what is happening here. WaWa is apparently concerned enough about the potential decrease in semi-impulse purchases, such as you describe, that they have some fliers by the cash register that address the issue.

ReplyDeleteIn New York City, things got much worse today, as I just read that banks are planning to start charging upwardss of $5 for each ATM transaction, to try to make up for revenue lost under new consumer protection rules instituted over the past two years.

Thanks for the clarification. I use Affinity so maybe I won't get a charge.

ReplyDeleteI’m in the same boat as you Greg except I go to the Quick Check near my work which is free. I’m ditching TD Bank and switching to Somerset Savings as soon as I find the time. They seem to have free everything checking and refund you the fees that other banks charge when using their ATMs. But, now I have to open new accounts, change direct deposit, etc, etc. Big bummer!

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDelete